Learning More About Gold Ira Companies

Best Gold Ira Companies Of 2022

Screenshot: Oxford Gold Group Info Kit This business works with investors to develop a financial investment method for minimizing risk, and then uses that approach to notify buying precious metals. Oxford is happy of their customized friendly service and convenient access to their 24/7 client care group- must question emerge throughout your investment journey.

Getting going with a gold or silver IRA with Oxford Gold Group consists of 3 actions: First, you'll complete a Self-Directed individual retirement account application and mail, fax or email it straight to Oxford. You can also call at ( 888) 200-5586. It takes 24 hr for your brand-new account to get set up.

Once settled, it takes about three to 5 business days for your funds to move into your new Valuable Metals IRA. Lastly, when your new IRA is moneyed, your account executive will talk to you about the metals alternatives offered and walk you through selecting the very best ones. After you've made your choice, the metals are delivered to the depository and saved.

Best Gold Ira Companies 2022: Reviews, Ratings, Complaints

Birch Gold Group Great Online Education 5 Stars Considering That 2003, Birch Gold Group has been selling physical gold, silver, platinum and palladium to be put in an individual retirement account or kept for physical ownership. They have actually given that become a leading business in Precious Metals IRAs and strive to inform consumers on the finest method to turn rare-earth elements into a long-lasting financial investment.

This uses a layer of protection distinct to this type of Individual retirement account. The company will educate you in person or online about how Precious Metals IRAs can diversify your portfolio, hedge against inflation and reveal strong growth potential.

American Hartford Gold Great Buyback Strategy 4. 6 Stars Source: American Hartford Gold Based in Los Angeles, American Hartford Gold specializes in Gold and Rare-earth Elements Individual Retirement Accounts. Signing up for a Valuable Metals IRA is simplified to a three-step process with American Hartford Gold Group. The initial step is to call a American Hartford IRA Item Professional who walks you through the needed documents.

What You Need To Know Before Opening A Gold Ira

If you're rolling over an existing account, your new Valuable Metals individual retirement account will have funds moved to it within 3 days. Once your new Valuable Metals individual retirement account has funded, you can select your metals. You'll buy your precious metals which will be stored in an IRA-approved vault. American Hartford Gold stands out thanks to its Buy, Back Dedication.

For more information, read our full American Hartford Gold evaluation. If you are interested in contacting American Hartford Gold, you can call 877-672-6779 or demand a totally free starter kit. Additional Gold IRA Companies American Valuable Metals Exchange is among the biggest precious metals dealerships concentrating on rare-earth elements for Gold individual retirement account accounts.

Noble Gold offers a simple Gold IRA rollover procedure and precious metals financial investment assistance. Rosland Capital's professionals assist clients choose precious metals that are in compliance with IRS rules for Gold IRAs.

Best Gold Investment Companies

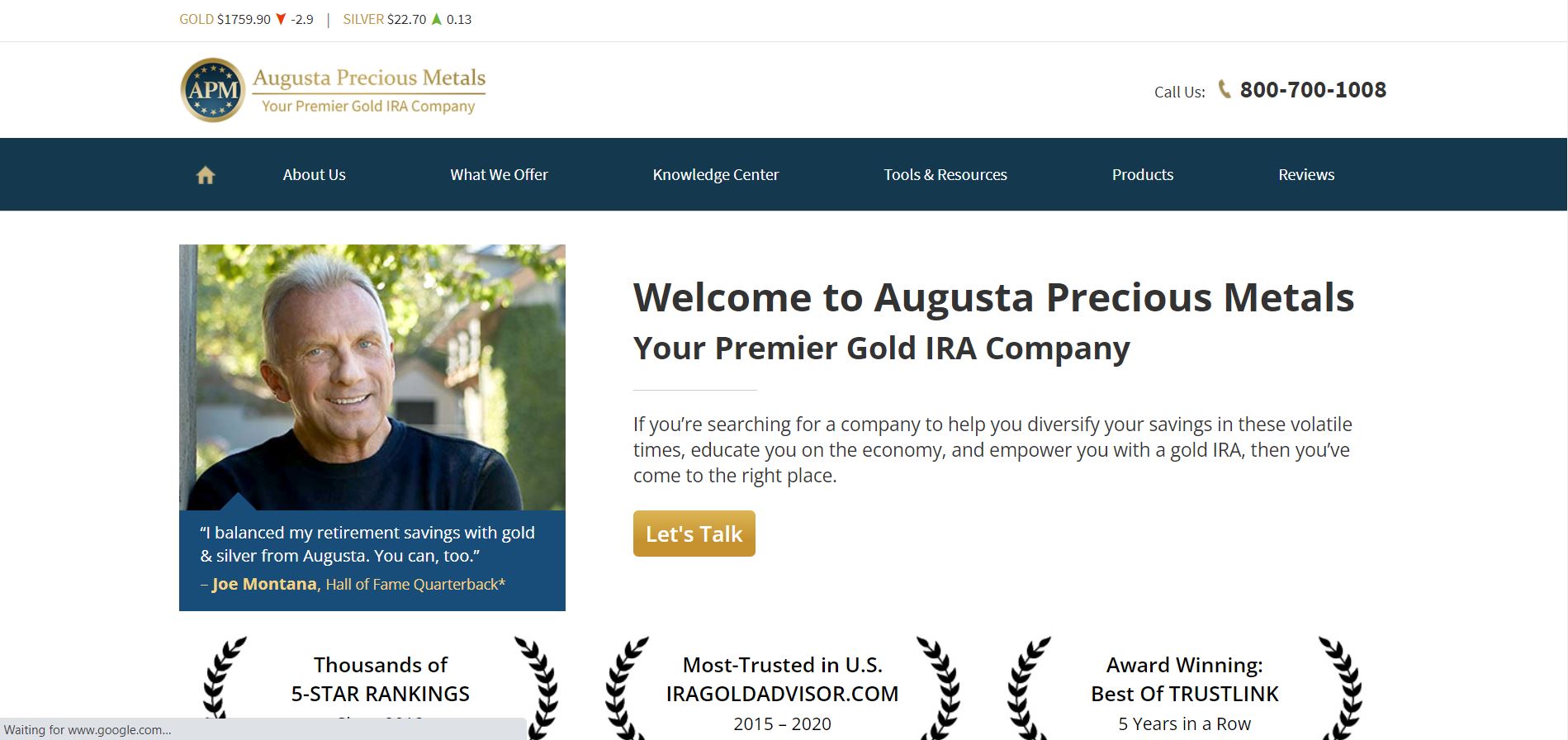

Augusta Valuable Metals provides each consumer with a consumer service partner to help with the buying procedure. Have a look at our Augusta Valuable Metals extensive evaluation. Lear Capital uses a $180 yearly management cost and a reputation for excellent client service. Take a look at our Lear Capital extensive evaluation. Related Gold Individual Retirement Account Resources Readers of this Gold individual retirement account guide also discovered these associated articles valuable. best gold ira companies 2022.

There are many methods to invest in gold in addition to a Gold Individual retirement account. Inspect out 7 of the most popular types of investing in gold.

Review them to get an understanding of how an account can be started to help you develop wealth in retirement. What is a gold individual retirement account? A Gold individual retirement account is handled similar as a traditional IRA (Individual Retirement Account). The main difference is that the possessions held are physical gold bars, coins, or other rare-earth element pieces.

Gold Ira Rollover Companies - Precious Metals Investing

To find out more on Individual retirement accounts, see the internal revenue service guidance on Individual retirement accounts. Why should I purchase a gold individual retirement account? While it is a personal choice to choose a gold individual retirement account, many financiers prefer them over standard IRAs because gold is seen as a possession that could hold its value versus serious market changes and inflation.

Is a gold Individual retirement account safe? If you feel that investing in gold is an excellent threat, then you'll likely find a gold IRA to have similar assurances.

Which gold is better 24K or 22K?

22K gold is preferred in case of jewellery. It is because 24K gold is malleable in its pure state and jewellery made with this kind of gold will break easily. Thus, most people prefer 22K over 24K gold as it also helps them to get better value when sold.

Is gold price going to increase?

If we look from year-to-date perspective, MCX gold rate has registered 11.70 per cent rise in 2022. In spot market, yellow metal price today breached $2,000 per ounce levels, logging around 8.80 per cent rise in year-to-date time.

What will be the gold rate in 2022?

Gold rates today, 25 March 2022: Gold rates in Delhi per 10 grams of 22 carats is at Rs. 47,340 and the rate of 10 grams of 24 carats is at Rs. 51,660.

How do I invest in gold stocks?

Return rates of physical gold are never profitable if you invest in the gold jewellery. The reason being that the price of jewellery is not only determined by the gold rates but it also includes the making charges and this is the just the half story i.e. when you purchase the gold.

A trustworthy gold IRA business can help you with the purchase, storage, and sale of your gold investments, along with rolling over standard Individual retirement accounts, 401(k)'s, and eligible retirement fund account properties to a gold IRA account. Do gold IRAs just deal with gold? The other name for "gold individual retirement account" is "precious metals individual retirement account" (etfs physical gold).

Goldco Reviews

Can I do a gold IRA rollover? Many of those who pick to invest in a gold IRA do so with funds they obtained while utilizing a standard Individual retirement account or company-managed 401(k).

Numerous financiers pick to roll over simply a portion of their IRA or 401(k) to a gold IRA as a method to diversify their nest egg. Just how much do I require to begin? Each gold IRA company will have its own minimum financial investment requirement, but it's possible to open an account with just $100 in financial investments, plus any suitable storage and administrative costs. top gold investment companies.

Research each business to get the best worth for your investment dollar. Can I see my rare-earth elements in individual? While each company has various arrangements for the storage and transfer of gold, silver, and other bullion, numerous do use separate storage areas for each investor. This is called "segregated storage" and it guarantees that each financier's metals are saved specifically for that financier.

gold ira investing read more see this check it out